TDS Online Payment – Income Tax Challan 281 Fill online, TRACES Login, Registration, NSDL TDS Payment, Tax Payment at onlineservices.tin.egov-nsdl.com.

TDS Online Payment is an online payment portal made by the Indian government for paying taxes and challans online. This portal is made by taking the motive of saving time and the make the work fast. The portal holds the connectivity of online challan cut by the officers. On this portal, people can fill out their income tax and also fill out their challan on one portal. This is a government portal and all people can use it for giving all types of taxes to the government.

TDS Online Payment – Income Tax Online Challan, TRACES Login

The TDS Online Payment is now available on the portal. All candidates can visit the official portal for giving the TDS Online Payment. The tax filing service is given online by the government and now the tax filing service is available for all citizens of India.

TRACES Login

TRACES is an online application of the Income Tax Department that gives an interface to all stakeholders connected with TDS administration. It gives the service of viewing challan status, downloading of Console File, Justification Report, Form 16 / 16A as well as viewing of annual tax credit statements online (Form 26AS). The portal holds all the information about the challans and Conso files updated online will be shown to you on this portal easily by your challan number.

How to Pay TDS Challan Online

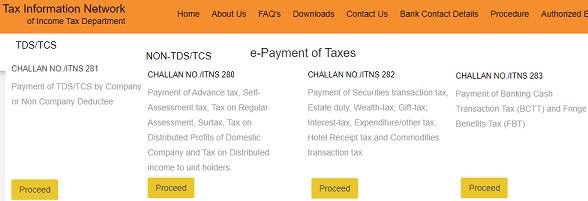

Candidates who want to pay TDS Challan Online can now do this by visiting the official portal and also in offline mode. The candidate must have a challan number for filling their TDS AND Non-TDS Challan. To fill the challan online please check the given details below and make your online payment of challan.

- Visit the official website of TDS.

- Now check your Chalan is TDS or Non-TDS.

- Now click on TDS or Non-TDS Challan on behalf of your challan.

- Now fill source and type of payment and select the challan type.

- Now fill the nature of payment and mode of payment and account number in the given fields.

- Now fill all the mandatory details in the given fields.

- Now fill the captcha code.

- Click on proceed button.

- Now your challan payment will be done after visiting some steps successfully.

- If you want to pay Non-TDS Challan then please select the Non-TDS option on the homepage.

Income Tax Challan 281 Online Payment

Income Tax Challan 281 Online Payment Service is also started on the official portal. The candidates can fill out the Income Tax Challan 281 Online by checking the details given below and can fill out the challan money online. See the given points below and follow them.

- Visit the official website of TDS. i.e. onlineservices.tin.egov-nsdl.com.

- Click on the “Income Declaration ” option given on the homepage.

- Now click on proceed.

- Fill your challan number in the given fields and fill the bank details.

- Now click on the proceed button.

- Now you can fill the challan online.

| Official Website | Click Here |

| For more updates visit | Helpline Portal |

If you have any problems or any questions then comment in the comment box. We will reply to you soon.